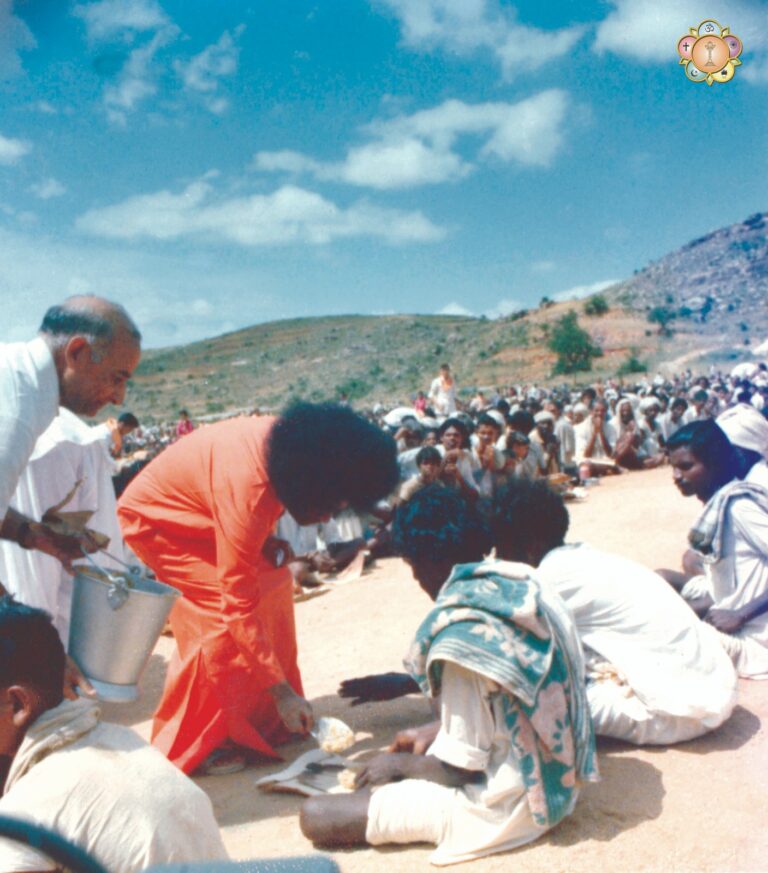

LOVE ALL SERVE ALL

Sri sathya sai global council foundation

“Try to assuage, as far as you can, the distress of others; when done sincerely, it is the best spiritual practice for a true spiritual aspirant”.

Sri Sathya Sai Baba Discourse 13th of January, 1968

HELP EVER HURT NEVER

Who We Are

VISION

To improve the lives of people in communities across the world that are undergoing hardship by providing assistance in the form of food, clothing, shelter, medical care, and values education.

VALUES

Our work is guided by the principles of ‘Love All, Serve All” and “Help Ever, Hurt Never” as demonstrated by Sri Sathya Sai Baba. This includes, demonstrating, practicing, and propagating the five human values of Truth, Right Action, Peace, Love, and Non-violence that are common to all cultures and religions.

What We Do

MISSION

Emphasis is on providing assistance to low income, disadvantaged individuals, families, communities, and institutions that are dedicated to serving those in need. This can include:

Education Support

Providing education support via providing tutoring and courses for students and teachers

Housing Support

Providing housing support, such as supplies and labor to help with repair and construction

Food

Providing food such as supplies to pantries, and kitchens serving at need populations

Disaster Relief

Aiding from time to time to victims of disasters, by providing food packets, hot meals, living supplies such as clothing, diapers, household cleaning items, disinfectants, blankets, and sleeping bags

Financial Support

Providing financial assistance and medical equipment, medication and supplies to existing free medical clinics and hospitals as well as developing additional free medical clinics in the USA

International Aid

Providing financial assistance and medical equipment, medication and supplies to clinics and hospitals associated with the Sri Sathya Sai Central Trust, a nonprofit charity registered with the Indian government, or in other countries, that have nonprofit status with their national governments, that provide free medical care

ONGOING | PAST EVENTS

Ukraine Service 2022

Due to the conflict occurring in Ukraine, many people are suffering. Globally, non-governmental organizations have mobilized humanitarian relief efforts to render assistance to the desolate Ukrainians victims and to the distressed refugees in neighboring countries. Communities and organizations in the sheltering countries are in critical need of supplies including clothing, food, hygiene items, sleeping bags, tents, toiletries, etc.

By Swami’s Grace and Blessings, after surveying the victims’ needs, the Sai Disaster Response Team of SSSGC has taken initiative to research ways in which assistance can be provided to local Ukrainian churches and organizations which have means to transport the needed supplies (listed in the attachment) to the affected areas.

Ida Service 2021

A category 4 Hurricane Ida lashed and ravaged Louisiana on Sunday, August 29, 2021 making landfall near Port Fourchon with ferocious winds of 150 mph. Ida then churned inland, bringing catastrophic winds, heavy rainfall, and tornadoes, along with flash and urban flooding along the coasts of Louisiana, Mississippi, and Alabama.

Haiti Service 2021

A massive earthquake hit the Les Cayes area of Haiti on Aug 14th, 2021 causing significant damages to homes and other facilities. Official estimates indicate there are more than 2,200 fatalities and over 14,000 injured with overall 1.2 million people, including 540,000 children affected.

WAYS TO CONTRIBUTE

CHECK

“Sri Sathya Sai Global Council Foundation, Inc.”

Mailing Address:

23203 Rainbow Arch Dr, Clarksburg MD 20871

Attention: Mr. Angira Desai

Note: Include your Phone#, Email id along with the check.

Zelle payment

You can also make donations using “Zelle” option.

Our Zelle I.D. is “treasurer@sssgcf.org” (Sri Sathya Sai Global Foundation).

In the memo, please enter your email address or phone number along with your comments before sending the zelle payment.

REgistered Address

5716 Stone School Lane,

Frederick, MD 21704

General inquiries, please contact @ secretary@sssgcf.org

Frequently Asked Questions

Technical faq's

Since there may be a potential for conflict with the SSSSGCF’s mission if certain gifts are accepted, the Board of Directors has adopted the following Gift Acceptance Policy:

Values – Whether accepting the gift compromises any of the core values of the SSSGCF.

Compatibility – Whether there is compatibility between donor’s intent and the organization’s use of the donation.

Public Relationships – Whether acceptance of the gift damage the reputation of the SSSGCF’s name in general and Bhagavan Sri Sathya Sai Baba’s name in particular.

Primary Benefit – Whether the benefits of the donations pass on to the SSSGCF without any rights reserved in favor of the donor.

Consistency – Whether acceptance of the gift is consistent with prior practices of the SSSGCF and the Sri Sathya Sai Central Trust.

Form of Gift – Whether the donation offered is in a form that the SSSGCF can use without incurring substantial expenses or difficulties.

Effect of Future Giving – Whether the donation encourages or discourages future donations to the SSSGCF.

All decisions to accept potentially controversial donations will be made by the Board of Directors of the SSSGCF, and their decision will be final.

Kindly refer to the “Gift Acceptance Policy” on SSSGCF’s website https://www.sssgcf.org for more information.

1) Donations of securities that are subject to restrictions or buy-sell agreements

2) Documents naming SSSGCF as trustee requiring the Organization to act in any fiduciary capacity

3) Donations requiring SSSGCF to assume financial or other obligations

4) Transactions with a potential conflict of interest

5) Donations of property that may be subject to environmental or other regulatory obligations

Kindly refer to “Gift Acceptance Policy” on SSSGCF’s website https://www.sssgcf.org for more information.